Insurance coverage for mold damage varies significantly among policies and insurers. Standard homeowners insurance typically offers limited protection, while specialized coverage is available through endorsements or separate policies. Coverage often depends on whether the mold results from a covered peril, with sudden damage more likely to be covered than gradual issues. Common exclusions include mold caused by neglect, flooding, or construction defects. To strengthen claims, homeowners should document mold issues thoroughly, maintain proper moisture control, and address water-related problems promptly. Understanding policy terms, exclusions, and prevention strategies is crucial for effectively managing mold-related risks and potential claims. Exploring additional coverage options can provide more comprehensive protection.

Types of Mold Coverage

The types of mold coverage available in insurance policies vary widely, depending on the insurer and specific policy terms. Standard homeowners insurance policies typically offer limited coverage for mold damage, often excluding it entirely or capping payouts at low amounts. However, some insurers offer specialized mold coverage as an endorsement or separate policy.

Comprehensive mold coverage may include remediation costs, structural repairs, and personal property replacement. Some policies cover mold damage only if it results from a covered peril, such as burst pipes or storm damage. Others may provide broader coverage for mold growth due to humidity or poor ventilation.

Commercial property insurance often includes more extensive mold coverage options, particularly for businesses in high-risk industries or locations. Water damage policies may also cover mold as a secondary effect of water-related incidents. Specialized environmental insurance policies can offer the most comprehensive mold coverage, including protection against third-party claims and business interruption losses due to mold contamination.

It's crucial for property owners to carefully review their policies and consider additional coverage options if they're concerned about potential mold risks. Consulting with an insurance professional can help clarify coverage details and identify any gaps in protection.

Common Policy Exclusions

Most insurance policies contain specific exclusions related to mold damage, limiting or eliminating coverage in certain situations. These exclusions often include long-term mold growth resulting from neglect or poor maintenance, as well as mold caused by flooding or earth movement. Many policies also exclude mold damage in unoccupied or vacant properties, as insurers expect homeowners to regularly inspect and maintain their properties.

Another common exclusion is mold growth due to construction defects or faulty materials. In such cases, the responsibility may fall on contractors or manufacturers rather than the insurance company. Policies may also exclude mold remediation costs if the mold is not directly related to a covered peril, such as sudden water damage from a burst pipe.

Some insurers exclude mold damage altogether, while others may offer limited coverage with strict caps on payouts. It's crucial for policyholders to carefully review their insurance documents and understand these exclusions. If broader mold coverage is desired, homeowners may need to purchase additional endorsements or specialized policies to ensure adequate protection against mold-related losses.

Sudden vs. Gradual Damage

Insurance policies typically distinguish between sudden and gradual damage when it comes to mold coverage. Sudden damage refers to mold growth resulting from an unexpected, identifiable event, such as a burst pipe or storm damage. These incidents are more likely to be covered by standard insurance policies, as they are considered accidental and unforeseen.

Gradual damage, on the other hand, occurs over an extended period and is often the result of ongoing issues like persistent leaks, poor ventilation, or inadequate maintenance. Most insurance policies exclude coverage for gradual mold damage, considering it a preventable problem that falls under the homeowner's responsibility.

To determine whether mold damage is sudden or gradual, insurers may investigate the cause and timeline of the growth. They may also consider factors such as the policyholder's maintenance practices and promptness in addressing water-related issues. It's crucial for homeowners to regularly inspect their property, address moisture problems promptly, and maintain proper documentation of any sudden events that could lead to mold growth. This approach can help strengthen their case for coverage if a mold-related claim becomes necessary.

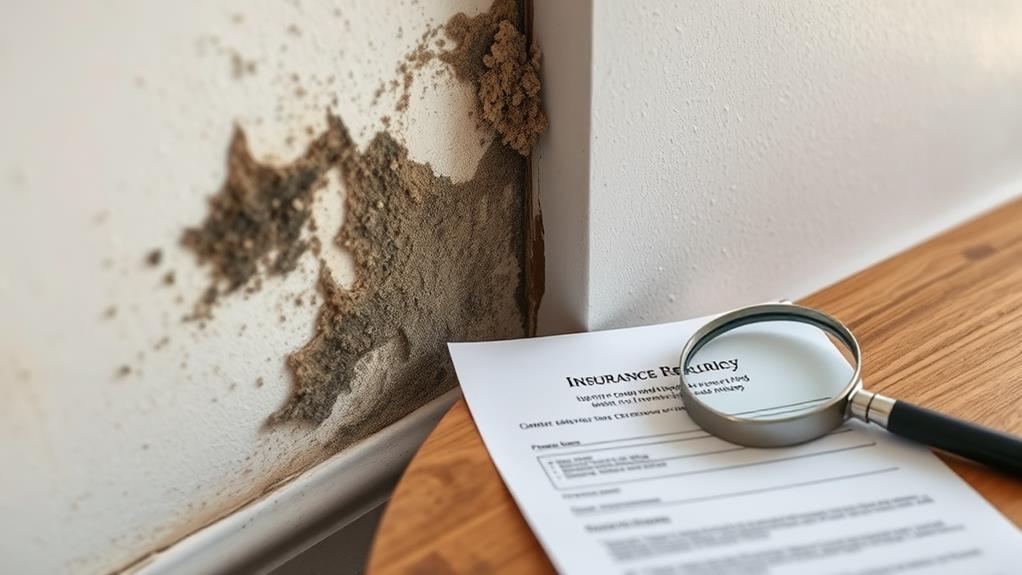

Documenting Mold Issues

Proper documentation of mold issues plays a key role in the insurance claims process and can significantly impact coverage decisions. To strengthen your claim, begin by photographing all visible mold growth, water damage, and affected areas. Include close-up shots and wider angles to provide context. Document the date and location of each photo.

Keep a detailed log of when you first noticed the mold, any attempts to remediate it, and conversations with professionals or your insurance company. Save all receipts related to mold testing, cleanup, or repairs. If you've experienced health issues due to mold exposure, maintain medical records and doctor's notes.

Engage a certified mold inspector to conduct a thorough assessment and provide a written report. This professional evaluation can offer valuable evidence of the extent and cause of the mold problem. Additionally, obtain written estimates from licensed contractors for necessary repairs and remediation.

Maintain a chronological file of all correspondence with your insurance company, including emails, letters, and notes from phone calls. This documentation trail can prove invaluable if disputes arise or if legal action becomes necessary.

Prevention and Maintenance Tips

A homeowner's best defense against mold-related insurance claims is proactive prevention and regular maintenance. To minimize mold growth, focus on controlling moisture levels throughout your home. Regularly inspect plumbing systems, roof, and foundation for leaks or signs of water damage. Promptly repair any issues to prevent water accumulation.

Maintain proper ventilation in bathrooms, kitchens, and laundry areas by using exhaust fans and opening windows when possible. Keep indoor humidity levels between 30-50% using dehumidifiers if necessary.

Clean and dry any water-damaged areas within 24-48 hours to prevent mold spores from taking hold. Ensure proper drainage around your home's foundation by maintaining gutters, downspouts, and grading. Regularly clean air conditioning drip pans and drain lines to prevent blockages.

Use mold-resistant products when renovating or building, especially in moisture-prone areas. Conduct routine inspections of potential problem areas, such as basements, crawl spaces, and attics. Address any signs of mold growth immediately. By implementing these prevention and maintenance strategies, homeowners can significantly reduce the likelihood of extensive mold damage and subsequent insurance claims.

Filing a Mold Claim

When faced with mold damage, homeowners should take several crucial steps to file an insurance claim effectively. First, document the damage thoroughly with photographs and detailed notes, including the date of discovery and any potential causes. Contact your insurance provider immediately to report the issue and initiate the claims process.

Review your policy carefully to understand your coverage limits, deductibles, and any exclusions related to mold damage. Many policies have specific limitations on mold-related claims, so it's essential to be aware of these restrictions. Obtain multiple estimates from licensed mold remediation professionals to support your claim and demonstrate the extent of the damage.

Cooperate fully with the insurance adjuster assigned to your case, providing all requested information and documentation promptly. Keep detailed records of all communications with your insurance company, including dates, times, and the names of representatives you speak with. If your claim is denied or you disagree with the settlement offer, consider hiring a public adjuster or attorney specializing in insurance claims to help navigate the appeals process and negotiate on your behalf.

Additional Coverage Options

While standard homeowners insurance policies often provide limited coverage for mold damage, many property owners find these basic protections insufficient. To address this concern, several insurance companies offer additional coverage options specifically tailored to mold-related issues.

One common option is a mold endorsement or rider, which can be added to an existing policy for an extra premium. This supplemental coverage typically increases the policy limits for mold damage and may extend protection to scenarios not covered by the standard policy. Some insurers also offer standalone mold insurance policies, providing more comprehensive coverage for mold-related risks.

Another alternative is an environmental insurance policy, which can cover a broader range of contaminants, including mold. This type of policy may be particularly beneficial for commercial property owners or those in high-risk areas for mold growth.

For homeowners in flood-prone regions, considering a separate flood insurance policy is crucial, as it often includes coverage for mold resulting from flood damage. Additionally, some insurers offer preventive services, such as mold inspections and remediation assistance, as part of their enhanced coverage options to help mitigate potential mold issues before they become severe.

Frequently Asked Questions

Can Mold Damage Affect My Health Insurance Coverage?

Mold damage typically doesn't affect health insurance coverage directly. However, health issues resulting from mold exposure may be covered. It's important to consult your specific policy and provider for details on coverage related to mold-induced health problems.

How Long Does It Take for Mold to Grow After Water Damage?

Mold growth can begin within 24-48 hours after water damage occurs, given the right conditions. Factors such as humidity, temperature, and available nutrients influence the speed of growth. Visible mold may appear within 1-2 weeks.

Are There Specific Mold Testing Requirements for Insurance Claims?

Like navigating a labyrinth, mold testing requirements for insurance claims can be complex. Many insurers demand professional assessments, including air quality tests and surface sampling. Documentation of visible mold growth and moisture levels is often necessary for claim approval.

Can I Switch Insurance Providers if My Current Policy Doesn't Cover Mold?

Yes, you can switch insurance providers if your current policy doesn't cover mold. Research different companies, compare coverage options, and ensure the new policy meets your needs before making the switch. Always review terms carefully before changing insurers.

Do DIY Mold Removal Attempts Impact Insurance Coverage for Future Claims?

Diligent DIY dalliances with mold removal may detrimentally affect future insurance claims. Providers potentially perceive prior personal attempts as problematic, possibly precluding coverage. Professional assessment and documentation are prudent precautions before pursuing any personal mold remediation efforts.

Conclusion

In conclusion, navigating the intricacies of mold-related insurance claims necessitates a comprehensive understanding of policy nuances. While certain circumstances may facilitate coverage, many policies incorporate limitations. Proactive measures and meticulous documentation are paramount. When confronted with microbial proliferation, expeditious action and adherence to proper protocols can significantly influence claim outcomes. For enhanced protection, policyholders may contemplate supplementary coverage options to address potential gaps in standard policies.